The Real Estate Taxes Florida Statements

Table of ContentsThe 7-Second Trick For Real Estate Taxes FloridaExcitement About Real Estate Taxes FloridaOur Real Estate Taxes Florida StatementsThe Only Guide to Real Estate Taxes FloridaThe Single Strategy To Use For Real Estate Taxes FloridaGetting The Real Estate Taxes Florida To WorkThe smart Trick of Real Estate Taxes Florida That Nobody is Talking About

Building tax obligations are the economic foundation of neighborhood federal governments. Residential property tax obligations likewise form regional housing markets by influencing the costs of purchasing, renting, or spending in residences and also home buildings.Home tax obligations are a really vital component of homeownership. Governments evaluate residential or commercial property tax obligations based on place as well as worth.

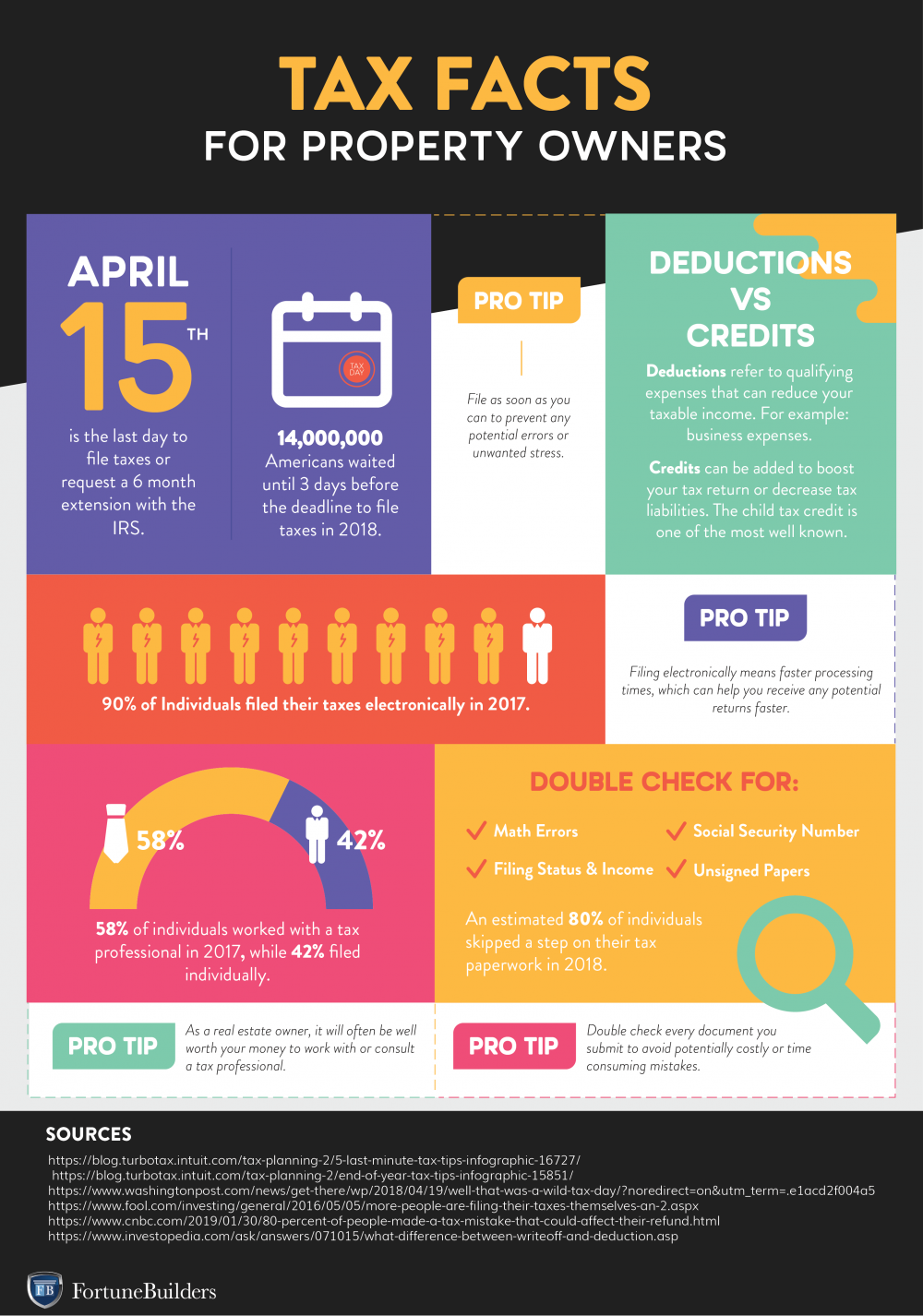

Below is a graph with demographics information from 2017, that reveals real estate tax and also just how much they make up the percentage of state profits. We can see which mentions depend a lot more on real estate tax than others. Alabama, Delaware, New Mexico, Hawaii, Arkansas are the leading 5 states with the least expensive percent to revenue.

The Facts About Real Estate Taxes Florida Uncovered

:max_bytes(150000):strip_icc()/factors-affecting-real-estate-market.asp_final-8e8ea4cd40dd45909593384700de9759.png)

These certificates are bid on, either by proposal down public auction where the rate of interest is reduced per bid or a premium proposal or bid up where the victor is the highest possible bidder. Individuals who wish to invest their cash have actually paid for the certificate since the passion troubled the unsettled tax is now obtained by the investor instead of the city government.

Real Estate Taxes Florida for Dummies

Those that want to foreclose will certainly need to also generate an action application that carries a cost as reduced as $39 yet can be up to $875 in some states however differs per state. If the foreclosure process is total after that the investor would certainly have the ability to obtain a residential or commercial property totally free and clear simply for the fees paid in taxes which would certainly be an excellent investment.

The lesson for home owners: make certain you maintain existing on your residential property tax obligation settlements as a result of the steep rate of interest rates that accumulate once the state sells your tax obligation lien. real estate taxes florida. As a house owner it is necessary to be vigilant in paying your real estate tax to take treatment of your asset as well as prevent paying much more in passion on unpaid taxes.

More About Real Estate Taxes Florida

Residential property tax obligation is a tax paid on property had by a specific or various other lawful entity, such as a corporation. Most generally, building tax obligation is a real estate ad-valorem tax, which can be considered a regressive tax obligation. It is calculated by a local government where the property is located and paid by the proprietor of the property.

, such as cars and also watercrafts.

Residential or commercial property tax obligation is based on the value of the property, which can be actual estate orin several jurisdictionsalso concrete personal residential property. Building tax obligation rates as well as the types of residential or commercial properties tired vary by jurisdiction.

Our Real Estate Taxes Florida Statements

However, the rate in the United States is significantly greater than in many European countries. Numerous empiricists as well as pundits have actually required a rise in residential property tax rates in created economic situations. They suggest that the predictability and also market-correcting personality of the tax obligation motivates both stability as well as correct growth of the property.

In some areas, the tax helpful site obligation assessor might be an elected authorities. The repayment timetable of property tax obligations differs by region.

Buyers should always complete a full evaluation of superior liens prior to buying any type of residential or commercial property. People usually utilize the terms home tax obligation and also genuine estate tax mutually. As well as it's partly real: Property tax is a real estate tax. That's not true the other method around. Not all real estate tax are actual estate tax obligations.

Rumored Buzz on Real Estate Taxes Florida

Right here's the distinction: Actual estate tax obligations are taxes on genuine residential or commercial property only; building taxes can consist of both real home and also tangible personal home (real estate taxes florida).

When a building is presently being rented, it generates a stream of monthly rental fee repayments. Some residential or commercial properties may have extra payments connected with them, such as for washing machines and also dryers, storage space, and also car parking. Relying on the balancing out cash discharges for home loan payments, residential or commercial property tax obligations, maintenance, and also so forth, the web cash inflows may be substantial.

Currently, the devaluation period for household actual estate is 27 years, while the depreciation duration for commercial buildings is 39 years. Depending on the location, realty has a tendency to appreciate relying on regional need levels. This can vary considerably within even a short range, however if you pick building meticulously, it can appreciate fairly significantly over a lengthy duration of time.

The 4-Minute Rule for Real Estate Taxes Florida

Ongoing increases in rising cost of living have a tendency to cut right into the earnings created from most forms of financial investment. This has actually traditionally not held true genuine estate, which has a tendency to appreciate at a rate quicker than rising cost of living. Part of the reason for this is that investors see property as a hedge against rising cost of living, therefore are more probable to bid up its rate when inflation is high.